This guest post is by Kiesha of WeBlogBetter.

Have you ever wondered how some bloggers never seem to run out of post ideas? They always manage to escape the dreaded writer’s block unscathed; they’re always full of inspiration. Ideas overflow and pour onto the page as they type feverishly. They’ve tapped into a mystical stream of never-ending stories.

What if I told you that you could tap into the same power?

Everything you’ve already learned and experienced can be used to create infinite and original ideas for your blog. If you can turn on the analytical and creative juices in your brain, you’ll never run out of ideas.

Almost anything you’ve learned in school, on the job—even life’s lessons in general—can be turned into useful analogies or comparisons. Music, television shows, movies, or videos can also be used as fuel for unique and engaging blog posts.

There are almost no limits to this technique. In fact, the more unlikely and unusual the comparisons you make, the better.

Using my personal experience to blog better

Whenever something evokes an “Aha!” moment for me, I immediately think about how I can use that principle for blogging.

For example, late one night, I was watching The Karate Kid. At the point when young Dre finally realizes that all those days and weeks spent picking up his jacket had really been preparing and strengthening him, my mind immediately connected that experience to blogging.

When Mr. Han said, “Kung Fu lives in everything we do … Everything is Kung Fu”, I jumped up like a hot coal had landed in my lap. I grabbed a pen and wrote:

“Blogging lives in everything we do … Everything is blogging! Every experience is potential blogging material!”

My husband thought I was going mad as I frantically scribbled this on an already over-filled piece of paper. It was a major “Aha!” moment!

Yes, everything in my life — even those experiences that I thought were useless wastes of time — had been preparing me for blogging.

You might not be able to see the similarities between blogging and manicuring nails, but what I learned years ago as a nail technician helps me blog better today. I was known for my creative airbrush designs and 3D nail art. I had more customers than I had time. It sounds like I should be rich by now, right?

Here’s the problem: I loved the design/art part of the process, but I hated the chemical aspects of the job. I also hate feet, which wasn’t the best of news for customers who wanted their toes to match their fingers. I suffer from the exact opposite of a “foot fetish.” Would that be a foot phobia? What I learned is that no amount of money justifies doing (or smelling) things you hate.

How does that translate to blogging?

Nothing, not even money, should be the reason for blogging about something you’re not passionate about.

I can see many parallels between applying acrylic nails and blogging.

They both require preparation

When applying acrylic nails, the surface must be adequately prepared. Skimping on this step creates the prime condition for the growth of fungus or other harmful pathogens that, if left untreated, could create medical problems for the customer.

With blogging, if you don’t take adequate time to prepare with research and fact checking, you could potentially steer a reader in the wrong direction. They may not be physically harmed, but advice you offer on your blog could harm a person’s business or their blogging efforts—and maybe even adversely impact their finances.

They Both Require Good Design

If I tried to put a beautiful design on a malformed nail, it only made the malformation more apparent. On the other hand, a well-formed nail with an ugly or bland design would be a waste of sculpting efforts. In other words, the nail had to be both well formed and display a beautiful design.

The same is true for a blog. You can have the most beautiful blog design, but if your site lacks valuable content, no one’s going to want to return. You need both good design and great content.

So you see, yes there is much to learn about blogging from doing nails. There is much to learn about blogging from everything—from all of your experiences.

Over to you

Have you ever thought about how your own abundance of personal experiences relates to your own niche? And how you can use that to create a blog unlike any other?

- Start by listing some of the most vivid experiences you’ve had, or lessons you’ve learned over the years.

- Then instead of thinking about how different they are from blogging, think about how similar they are.

- Use those points of intersection to highlight those similarities.

- Then mesh those ideas together to create something new.

What you’ll get is something totally unpredictable and extremely insightful.

Which pieces of your personal experience and life lessons could you use to create an interesting analogy or comparison in a blog post? Which could you use to help you improve your blogging in general?

Kiesha blogs at WeBlogBetter, offering blogging tips and tricks. She’s a technical writer, writing instructor, and blog consultant for small business owners. Connect with her on Twitter @weblogbetter.

In the digital age, nobody likes carrying a lot of cash around – I know I don’t, anyway. This can be especially frustrating when you go to keep track of your expenses, who you owe money to, who you lent some to and just where it all goes over the month.

As always, there are a lot of apps out there to help you do various things with your money. There are apps to figure out how to manage your money, oversee expenses, send money to people, keep track of who owes you, and more.

In this article, I’ll show you some of the applications you can take advantage of to do everything I’ve mentioned here, leaving you free to pick and choose the apps that will make your life easier.

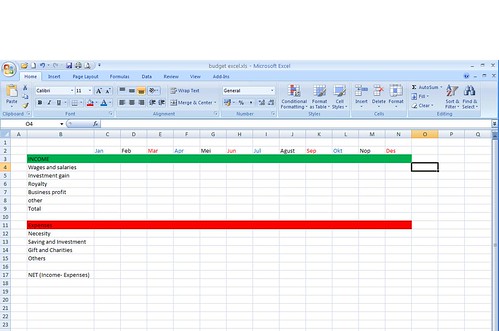

How to Manage Your Money

I’m beginning to learn just how difficult managing your expenses can be. For the most part, I use my debit card tied to my checking account to make purchases. I use it at the grocery store, when I go out to lunch with my coworkers and on the weekend when I’m out exploring the city.

At the end of the month, my bank statement looks pretty ridiculous. All of these small transactions make it difficult to sift through. I still know what everything is, but if I wanted to see where I could be saving some money I wouldn’t know the first place to look.

Sounds like you? Even if it doesn’t, you could still reap the benefits of visually being able to manage your money. These apps make the process a lot easier.

Mint

Mint has been on our radar since back in 2007 when Karl wrote about it. Plain and simple, if there is one app I want you to keep in mind it’s this one.

Mint is a free personal finance application that can help you compare your bank accounts, credit cards, CDs, brokerage and 401(k) to the best products out there. It offers a visual representation of your finances and is very easy to set up. Use it to manage your budget, get credit card advice and understand investing.

Here’s a great video showcasing an overview of Mint’s features:

For some helpful tips on how to use Mint, check out Bakari’s article on How To Use Mint To Manage Your Budget & Spendings Online.

Thrive

Thrive (directory app) is also a great application if you’re looking for a simple way to keep track of your spending. With Thrive, you get an overall Financial Health score, which is one number that shows you how financially fit you are. It also shows you scores in other areas and offers you advice on how to make improvements.

Thrive breaks down your spending for you and shows you where you can save. Compare your current budget to last month’s, as well as view a six month average and target budgets to follow.

Texthog

Looking for an even simpler way to track expenses? Texthog (directory app) lets you easily store, organize and access your receipts, expense reports and more via text message, the web, your email, iPhone and even Twitter.

A Texthog free account gives one user the ability to track expenses, view unlimited reports and get budget/bill reminders. Take a photo of your receipts and utilize tags and categories to keep track of everything.

To check out Texthog on your iPhone, you can find the application on iTunes.

Venmo

Speaking of text messages, have you heard of Venmo? Venmo (directory app) is a nice little app that lets you pay and charge friends with your phone. Send and receive secure payments by linking your card to your account. This allows you to settle small loans you give/get by eliminating paper transactions for small amounts of money.

To use Venmo, all you do is create an account. You can then send and receive money to other accounts simply by using text commands in SMS. Accept a “trust” request from your friends and make transactions without having to authorize them by texting a 3 digit code.

This is a pretty solid application that I have been using a lot lately with my friends/coworkers. It’s great for when a bunch of you are out to lunch and not everyone has cash on them. “I’ll just put it on my card and Venmo you all afterwards.”

Owe Me Cash

Owe Me Cash is a nice app I found recently that is also very easy to use. If someone owes you money, you just sign into Owe Me Cash with your Twitter, Facebook, OpenID, or regular account and tell the app about the debt. The app will send automatic reminders to those that owe you money by phone, text and email, so you can get paid!

This app is more fun than serious, but it doubles as an easy way to keep track of who owes you what. Let the app bug your friends to pay you so you don’t have to do it yourself – it’s a win-win.

Conclusion

With these applications, your finances will never look better. Say goodbye to paper money and change.

What do you think of these money-managing applications? Will you be using any of them?

Image Credit: marema

alpine payment systems scam

Movie <b>News</b> Quick Hits: 'Paranormal Activity 3' Gets a Release Date <b>...</b>

This 'Toy Story' Engagement Ring Box is just too adorable. - It shouldn't be much of a surprise, but Oren Peli has confirmed that 'Paranormal.

Great Dolly <b>News</b>! | PerezHilton.com

Yes! We´re totes excited for this! Dolly Parton made the official announcement on her website today that she is planning not only a brand new album full of brand new music, but a worldwide...

Eva Longoria Files for Divorce from Tony Parker | TMZ.com

MAKE TMZ MY HOMEPAGE; TMZ RSS/XML � iPHONE APP � ANDROID APP � TEXT ALERT � FACEBOOK � MYSPACE � TWITTER � YOUTUBE � TIPS � Sign In | Sign Up. HOT SEARCHES: Sebastian Bach | Princess Diana | Brittny Gastineau � TMZ AOL News ...

Movie <b>News</b> Quick Hits: 'Paranormal Activity 3' Gets a Release Date <b>...</b>

This 'Toy Story' Engagement Ring Box is just too adorable. - It shouldn't be much of a surprise, but Oren Peli has confirmed that 'Paranormal.

Great Dolly <b>News</b>! | PerezHilton.com

Yes! We´re totes excited for this! Dolly Parton made the official announcement on her website today that she is planning not only a brand new album full of brand new music, but a worldwide...

Eva Longoria Files for Divorce from Tony Parker | TMZ.com

MAKE TMZ MY HOMEPAGE; TMZ RSS/XML � iPHONE APP � ANDROID APP � TEXT ALERT � FACEBOOK � MYSPACE � TWITTER � YOUTUBE � TIPS � Sign In | Sign Up. HOT SEARCHES: Sebastian Bach | Princess Diana | Brittny Gastineau � TMZ AOL News ...

alpine payment systems scam

Movie <b>News</b> Quick Hits: 'Paranormal Activity 3' Gets a Release Date <b>...</b>

This 'Toy Story' Engagement Ring Box is just too adorable. - It shouldn't be much of a surprise, but Oren Peli has confirmed that 'Paranormal.

Great Dolly <b>News</b>! | PerezHilton.com

Yes! We´re totes excited for this! Dolly Parton made the official announcement on her website today that she is planning not only a brand new album full of brand new music, but a worldwide...

Eva Longoria Files for Divorce from Tony Parker | TMZ.com

MAKE TMZ MY HOMEPAGE; TMZ RSS/XML � iPHONE APP � ANDROID APP � TEXT ALERT � FACEBOOK � MYSPACE � TWITTER � YOUTUBE � TIPS � Sign In | Sign Up. HOT SEARCHES: Sebastian Bach | Princess Diana | Brittny Gastineau � TMZ AOL News ...